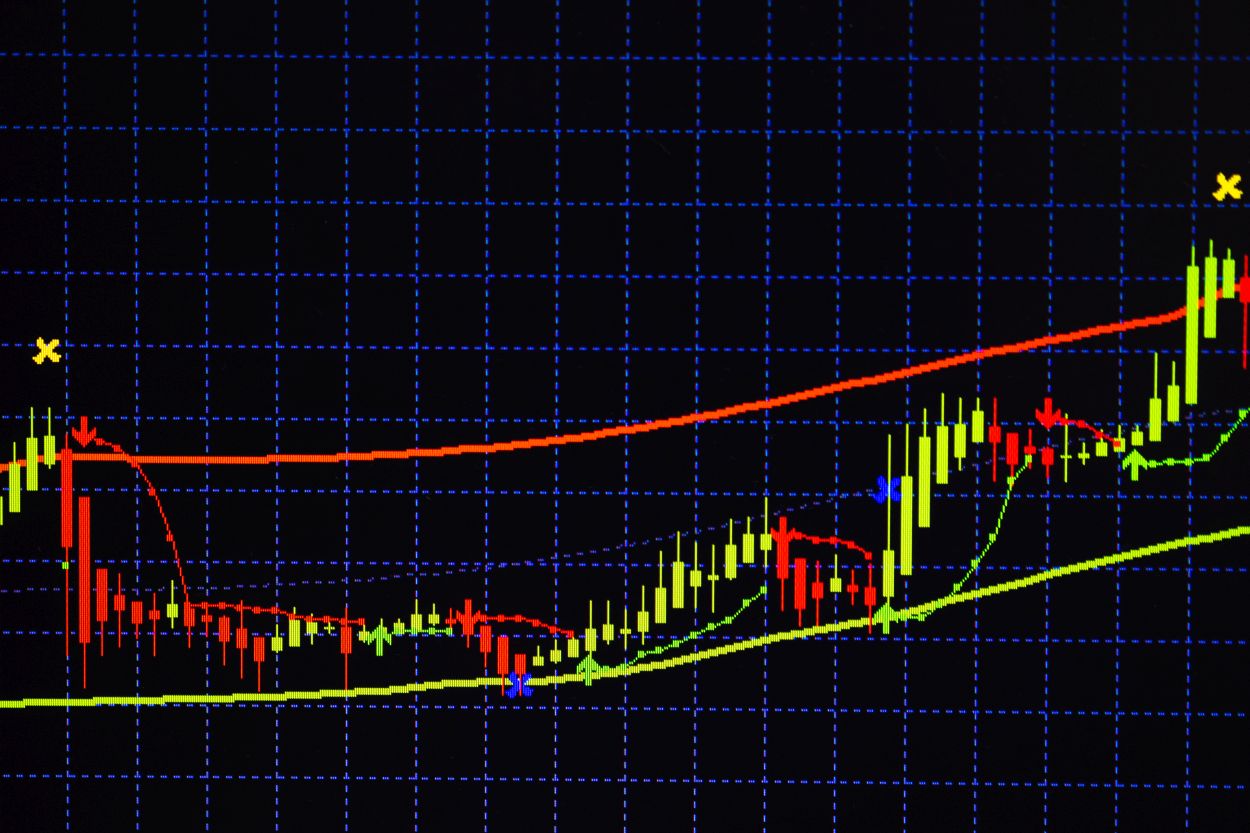

The West Texas Intermediate Crude Oil market plunged significantly during the trading session on Thursday to reach down to the 200 Day EMA. At this point, the market is starting to look at technical analysis as a potential support level. If we break down below the 200 Day EMA, the market then will test the hammer from the previous week, and if we were to break down through that hammer, then it should open up a bit of a “trapdoor” for sellers.

We are currently between the 200 Day EMA and the 50 Day EMA, which quite often will be a very noisy area, to say the least. Ultimately, the market is sitting just below the $100 level, which of course can cause a little bit of trouble as well. If we were to break above the $100 level, then we could test the previous uptrend line. The previous uptrend line of course is going to have a certain amount of “market memory” built into it, therefore I think it looks as if that could be a primary for sellers to come back in. If the market was to break above there, then we will almost certainly challenge the 50 Day EMA, which is at the $110 level. Breaking above that could of course be a very bullish sign, and it could open up the possibility of a move to the $120 level.