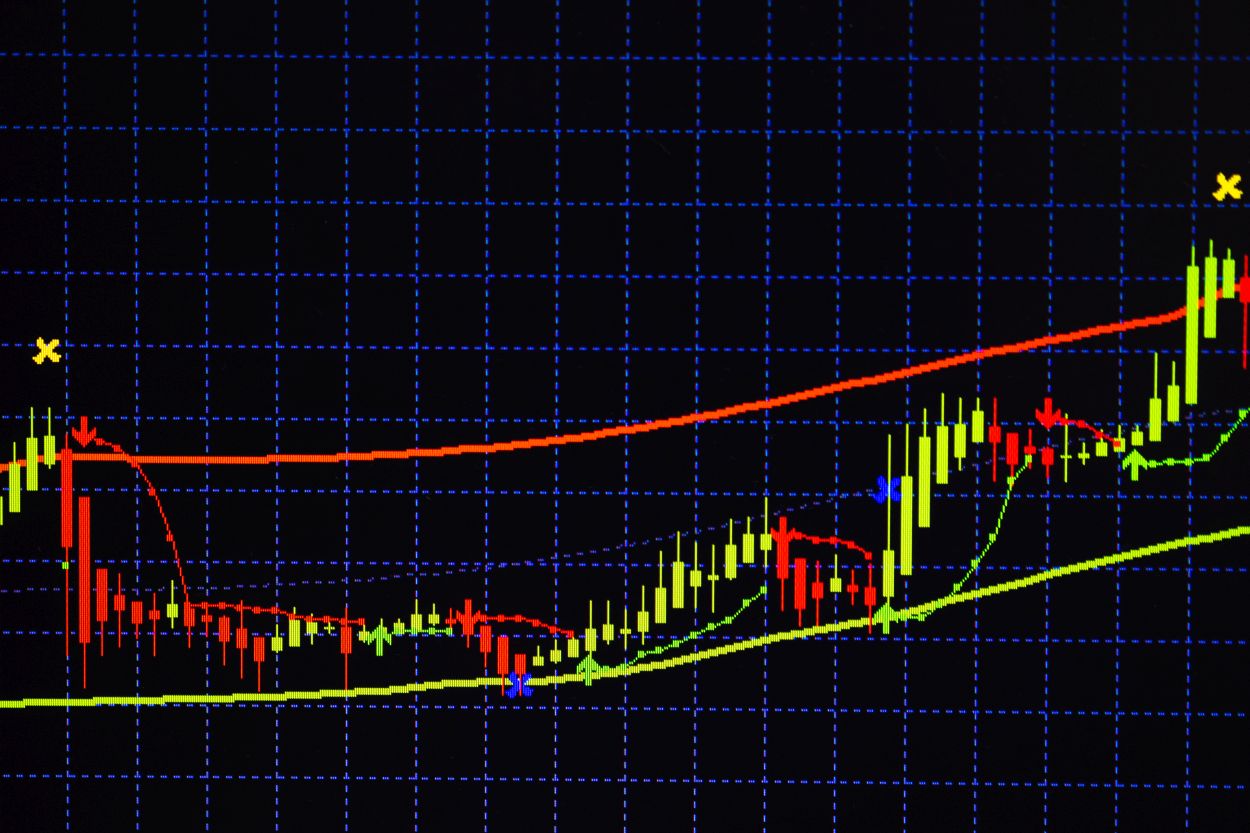

Today’s risk recommendation of TRY/USD is 0.50%. Best buy point Pending order entry of 18.50 Place stop point to close below 18.25 support level. Move stop loss to profit zone and watch profit when price moves 50 pips. Close half of the contracts at 70-pips profit and leave the remaining contracts at strong resistance at 18.99. Top Selling Entry Points Issuing a sell order as a pending order from the 18.99 level. Best points to place a stop loss near the maximum 19.15. Move stop loss to profit zone and watch profit when price moves 50 pips. Close half of the contracts with a profit of 70 points and leave the remaining contracts at the support level of 18.55. The price of TRY / USD has stabilized since yesterday, despite strong movements in global markets, after the decision to raise interest rates by 50 basis points in the United States. Despite the fact that the dollar is currently rallying against major and emerging market currencies, especially after the statement of the Chairman of the Federal Reserve Jerome Powell, where he emphasized the implementation of a strict fiscal policy until inflation slows down. It seems that the control of the Central Bank of Turkey over the lira exchange rate is currently the most important factor in the stability of the Turkish currency. It is supported by the central bank and is under the executive power of the country’s president, Recep Tayyip Erdoğan. He wants to boost the lira out of a desire to spread some kind of financial stability before the expected election. season in the middle of next year. It is worth noting that despite the stimulating monetary policy of the Central Bank of Turkey, the fact is that some of the procedures followed by the bank indicate a kind of extortion. For example, despite the decrease in interest rates in the country in several previous meetings, but the bank tightens the lending policy, which is not available to everyone. In light of the current control of the Central Bank of Turkey, the price of the lira is not expected to change significantly, except through a reduction of the bank’s indirect market intervention. TRY / USD Technical Analysis On the technical side, the dollar pair stabilized against the Turkish lira without major changes early today. Because the couple continued to trade in a limited area that trades near it for more than two months. Currently, the dollar pair has fallen below the 18. 0 and 18.20 levels against the lira. On the other hand, the pair is trading below resistance at 18.72, the pair’s highest record this year, and the pair is trading below psychological resistance at 19:00. At the same time, the dollar pair traded above the moving averages of 50, 100 and 200 against the lira in the daily time frame, indicating a general bullish trend for the pair. In a sign of divergence the pair registered, their averages traded on both the four-hour and lower time frames. in the medium term Every drop in the pair means an opportunity to buy back. Follow the recommendation’s numbers while maintaining capital control.

TRY/USD Forecast: Stability of the Lira Against the Dollar after the Interest Rate Hike