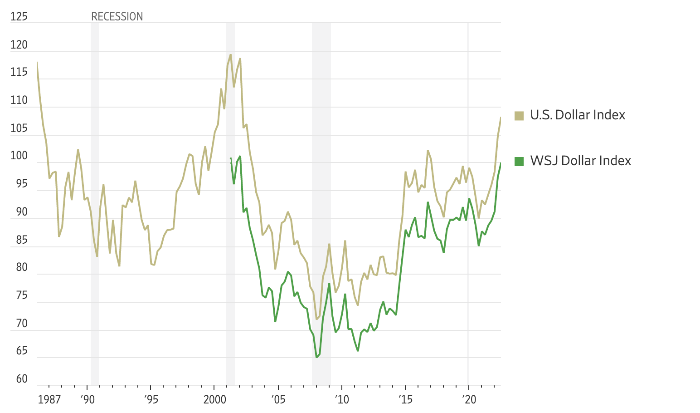

After the biggest drop in the US currency in the first half of the year in more than a decade, the actions of investors who are trying to protect themselves from falling stocks and rely on the stability of the US economy are helping to further growth. The WSJ dollar index, which measures the dollar against a basket of 16 currencies, hit a 20-year high last week and is up nearly 2.5% this month. The euro is trading below parity with the dollar for the first time since 2002, and the Japanese yen has fallen to lows last seen at the end of the 20th century.

Asset managers expect the Federal Reserve to do everything possible to stem the rise in consumer prices. After another spike in inflation last week, the Fed is likely to raise rates by another 0.75% this month. While not a full percentage point, as some feared, the gap between US rates and those in Europe or Japan will continue to widen. This could attract more investors into the currency who are looking for higher returns.

dollar index

Source: The Wall Street Journal

A strong dollar is a double-edged sword for American consumers and businesses. It stimulates purchases within the country, but negatively affects the income of multinational companies. Microsoft Corp. lowered its earnings forecast in June, having said in April that the strength of the dollar had reduced the company’s profits for the first three months of the year by about $300 million.

The dollar’s rise has hit dollar-denominated commodities ranging from oil to copper, undermining developing economies whose dollar-denominated debt is becoming more expensive to service as the US currency appreciates.

This week, investors will be keeping a close eye on second-quarter earnings from companies like Goldman Sachs Group Inc., Tesla Inc. and Alcoa Corp. Banks started the reporting season with mixed forecasts, as profits tumbled despite executives saying there were little signs of a recession.

“The dollar will certainly be a huge drag on profits,” said Adam Crisafulli, founder of research firm Vital Knowledge.

The pressure is rising

Investment managers will also be watching the European Central Bank meeting, trying to determine the direction of the euro. Analysts predict that the ECB will raise rates for the first time since 2011.

The ECB and BOJ continue to be loose, lagging behind the Fed and other countries that are rapidly tightening lending conditions to curb inflation. The Bank of Canada surprised investors on Wednesday by raising interest rates by a full point.

Hedge funds are betting against the euro, which has fallen nearly 15% against the dollar over the past year, due in part to the Russia-Ukraine conflict and related energy and inflation concerns. Data from Depository Trust & Clearing Corp. speak of an increase in the volume of options, payments on which are carried out with an acceleration of the fall of the euro.

“The forex market is taking into account a severe recession in Europe,” said Steven Gallo, Head of European Currency Strategy at BMO Capital Markets.

The yen continues to decline, having lost about 20% against the dollar over the past year. The Bank of Japan has pledged to maintain its low interest rate policy, including controlling the spread between short-term and long-term bond yields, known as the yield curve, despite signs of inflation.

“With the BOJ not expected to take any action on rates or the yield curve target any time soon, the yen will be driven by US yields,” said Sean Osborne, FX strategist at Scotiabank.

The pressure from the rising dollar extends far beyond Europe and Japan. Currencies that traders use to gauge economic growth sentiment and stocks like the Australian dollar have fallen in recent days as investors bet on slower growth.

“As the mood shifts, people are betting on the currency,” said Steve Englander, head of macro strategies at Standard Chartered in North America. “Pressure is simultaneously mounting due to concerns about interest rates, inflation, the shutdown of production in Europe and corporate earnings.”

The Australian dollar is down more than 10% from its April highs.

The dollar has room to grow

Wall Street analysts expect the dollar to continue rising as worries about a global recession intensify. Morgan Stanley raised its dollar forecasts last week and now expects the euro to trade at 97 cents by the end of September.

According to Michael Feroli, chief economist at JPMorgan for the US market, the June minutes of the Fed meeting indicate that the dollar still has room for growth. Previously, investors doubted whether the Fed would aggressively raise rates if it would hurt the US economy. According to the protocol, the central bank will do everything possible to stop inflation.

“The most notable change in rhetoric has been a growing acknowledgment that growth may have to be sacrificed to restore price stability, but they are willing to pay the price,” he added.