The strong ruble has become an additional factor in the slowdown in economic activity due to the Dutch disease

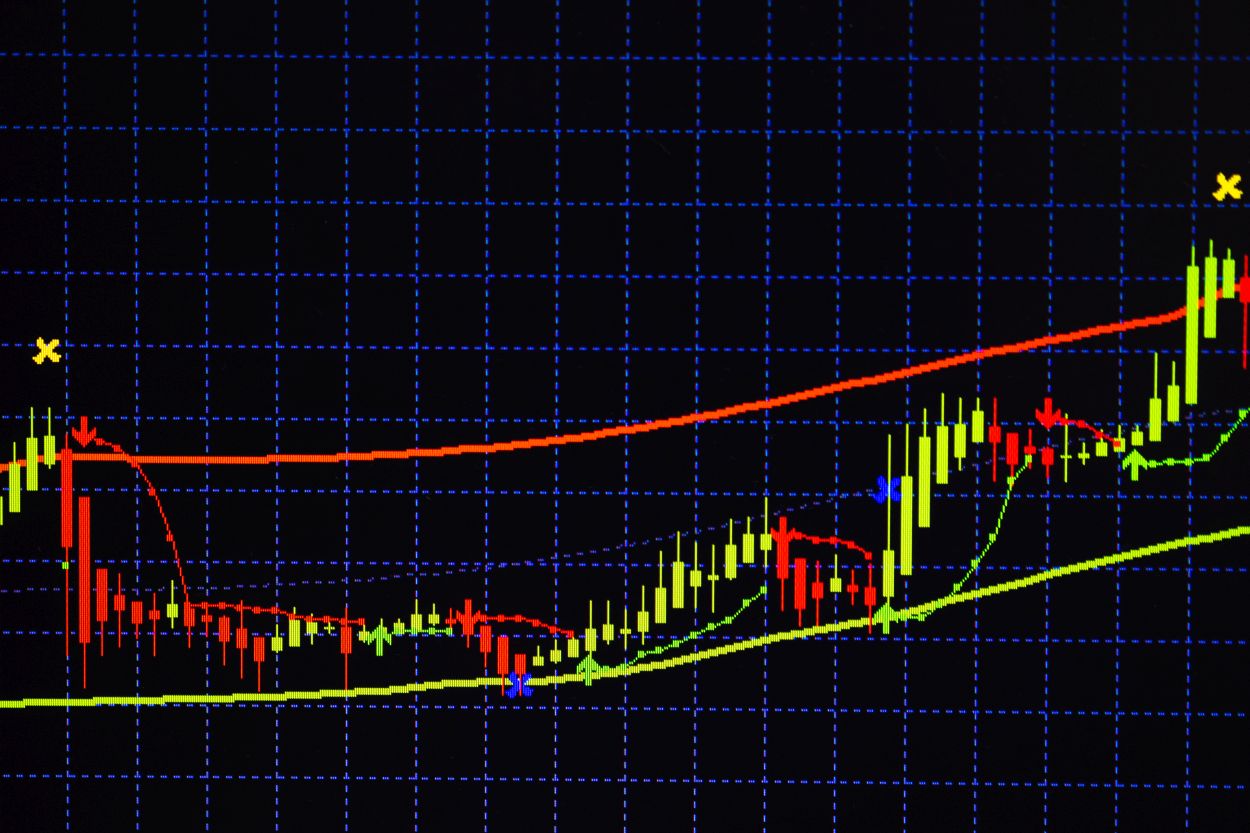

Dollar / ruble exchange rate on the Moscow Exchange at intervals of 1 minute

Dollar / ruble exchange rate on Forex at intervals of 4 hours

There is no opportunity to carry out interventions – real ones, but verbal ones work poorly, nor the ability to remove key currency restrictions, so the ruble continues to drag the Russian economy to the bottom. This Dutch disease led to the fact that equipment manufacturers began to complain about the dominance of Chinese imports, and Gazprom was forced to drastically reduce gas supplies to Europe due to unprofitability under the sauce of a sanctions war with the West. So they will stop selling oil abroad if the ruble rises to 40. Therefore, without delaying for a long time, the Central Bank used an effective tool, hitting a slightly insolent ruble. He cut the rate by 1.5%. And yesterday’s fall of the ruble – explained by many allegedly due to the easing of currency restrictions – may be an insider regarding the rate decision.

But I think these are half-measures in the conditions of such a huge surplus, when the rate is completely determined by foreign trade, and not by capital (as with normal people), operations. Taxes and dividends are paid next week. This will be a marker of whether the budget really forms the second bottom around 55, which, according to the rules of graphical analysis, should be higher than the previous one by 50. Let’s see. I think the ruble will win back. Until the parameters of the budget rule are announced, until real interventions begin, the ruble will continue to dangle from the tax payment cycle in the range of 50-70 rubles.